Transparency

Trust is Paramount

At Convexity, we are committed to full transparency with our clients. We are always happy to share every detail because our firm is designed with your interests in mind.

Transparency Builds Trust

All of our background data can be found at any time in our Finra profile; FINRA — the Financial Industry Regulatory Authority — is a government-authorized not-for-profit organization that oversees U.S. broker-dealers and acts to protect investors and ensure the market’s integrity.

Fee Transparency

Our invoices include an itemized breakdown; individual fee type, the dollar amount of each fee type, and the total fee amount.

First, you will receive an email from our invoice provider, Square.

If you ever have questions about the validity of the email invoice please contact us immediately. We are happy to verify the invoice before any payment occurs.

> Inside the email, there will be information about the invoice and a link to pay the invoice, and from there you will be taken to a page similar to the image shown here.

Square offers a selection of payment options.

> The payment methods include using your credit or debit card, Cash App Pay, as well as an ACH (automated clearing house) transfer through your bank.

> You can select any option that you like and if you so choose you may opt-in to save your information so that future invoices are automatically charged. This option is entirely up to you and you are under no obligation to save your payment method for future use.

Finally, every invoice is provided with a pdf version that you may download to keep for your records.

This lets you know exactly how much you were charged for our services and gives you clarity.

We put our numbers front and center not only because it is the right thing to do but also because our fees are among the lowest in the industry.

Learn more about the savings our clients enjoy here.

Zero Hidden Fees

Fee transparency gives our clients additional savings and access to the financial products and services they need in a clear and honest way.

An Example of How Other Firms Hide Fees

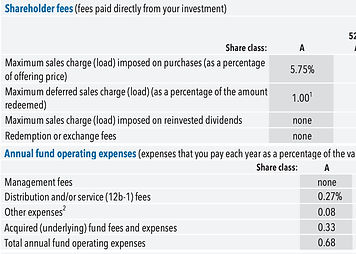

For this example, we used the data from a large and well-known mutual fund, which has over $14.3 billion in assets. The fund has a stated expense ratio fee (the percentage of assets that it charges per year) of 0.68%.

This fee is a composite of four other fees:

-

Annual Management Fee (0.00%)

-

Other Expenses Fee (0.08%)

-

Acquired (Underlying) Fund Fees and Expenses (0.33%)

-

Service 12b-1 (0.27%)

Added together, these equal 0.68%. There is no other mention of additional fees on the summary web page of the fund.

If you dig further, you can find that there are in fact more fees. In order to find these fees you have to review the prospectus of the fund, which is 122 pages long.

Within the prospectus, you will find two additional fees in a new category of fees called "shareholder fees". There is a "maximum sales charge (load) imposed on purchases (as a percentage of offering price)" which is 5.75% and a "maximum deferred sales charge (load) (as a percentage of the amount redeemed)" which is 1.00%.

The 5.75% maximum sales charge is a fee that is applied to any purchases of shares in the fund that are made. So, when you buy the fund you pay 5.75% in fees on however many dollars you spend.

For example, if you were to invest $10,000 in this mutual fund, $575 of that money would go to cover the fee while the remaining $9,425 would be invested.

The 1.00% maximum deferred sales charge is a fee that is applied every time you sell shares in the fund. So, when you sell the fund you pay 1.00% in fees on however many dollars you get for the sale.

In this case, if you were to sell $10,000 worth of shares in the fund, $100 would go to cover the fee and you would receive the remaining $9,900.

An Example of More Deeply Hidden Fees

In addition to the example above, there are even more ways for funds to hide fees from their investors, and they are even more difficult to detect:

A fund itself has operational expenses to keep the fund in business. Within these expenses, a fee can be recorded that will not show up anywhere else. This can be very difficult to determine because the fees will only be listed within the financial statements of the fund, which are found within the SEC's database, EDGAR (electronic data gathering analysis and retrieval), and are not obvious to investors.

Explore Our Services

Investors should conduct their own analysis prior to making any investment decisions. Diversification does not eliminate the risk of experiencing investment loss. Past performance is not a guarantee of future results. Investment process is subject to change. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All securities involve risk and may result in a loss. Investors should conduct their own analysis prior to making any investment decisions.

%20copy.png)